Are you wondering if you should rent your home but aren’t sure where to begin? Maybe you can’t decide because you don’t know if your home would even make a good rental property.

I can help because I’ve been through it myself. Actually, I’ve converted three of my own homes into rentals. But it wasn’t easy at first.

I struggled with the decision the first time because I had many of the same questions that you probably have right now:

- How much rent should I charge?

- What if no one will rent it?

- What if I get a bad tenant?

- Will I lose money?

- Etc.

But once I got over my fears, I took action and got busy finding the answers to these questions.

I found out the hard way that not every home makes a good rental. You can learn from my mistakes.

I needed to turn my first home into a rental but by the second and third times, I wanted to turn them into rentals. In fact, I planned to convert them even before I moved in.

In this article, I will help you get over your fears and give you the confidence to help get started. The first step is answering the fundamental question:

“Should you rent your home?”

Specifically, I will show you how to:

- Estimate your home’s cash flow potential

- Determine your local market demand

- Know the amenities that will attract tenants

Let’s get started determining if you should rent your home.

This article contains partner and Amazon affiliate links to products or services I find helpful. This means I may earn a commission, at no extra cost to you, if you purchase anything through a link. Thanks for your support!

Will It Cash Flow?

The first step in determining if you should rent your home is to look at the numbers. Specifically, you need to make sure there is enough cash flow.

There are a ton of articles and resources to help you calculate rental cash flow – including my own detailed article with a downloadable spreadsheet to get you started. I won’t go into the details here.

Instead, I will provide a comprehensive overview of what to consider when determining cash flow.

In case you’re not familiar with the term, cash flow is what’s left over after you subtract all of your cash expenses, including your full mortgage payment, from your monthly rent.

How Much Will It Rent For?

Many first time landlords get this first step very wrong. They figure the rent is determined by their expenses so they skip this step and jump down to estimating expenses.

Others use a basic resource like Zillow or Rentometer which will tell you what landlords are ASKING for rent. They only provide a wide range of what rentals are going for.

You need a comprehensive rent analysis of what similar properties in your area are ACTUALLY renting for.

I use RentRange every time I have to list a rental on the market. It helps me charge a competitive rent that gets it rented quickly.

See this example Rent Analysis report for details. Be sure to leave a little distance from the highest market rents. This will keep your rental competitive and rented longer.

Use referral code AR25OFF to save 25% off the wholesale cost for every report you ever run if you decide to sign up.

Next you need to estimate your cash expenses.

Did You Pay Too Much?

Your biggest cash expense is probably your mortgage. This is directly correlated to the price you paid for your home.

The problem is, most homeowners buy based on emotion and the value they believed they would receive from the home (larger yard, updated kitchen, etc.).

However, most renters think more rationally and simply don’t place as much value on the same things.

This means that sometimes the rent you can collect for your home isn’t as much as the value you paid for the home. That’s because you and your tenant value the property differently.

PRO TIP – You generally can’t rent your home if you just moved in. Most mortgages have an Occupancy clause that requires the mortgagee to physically occupy the residence for a while before it can be converted to a rental. The period is usually 1-2 years. Review your original mortgage paperwork before making a decision. You may need to wait a little longer before you can become a landlord.

PRO TIP – All VA loans must be owner occupied. You will need to refinance if you want to convert it to a rental. However, you may qualify for special financing options.

PRO TIP – If you own a Condo or are otherwise subject to a Homeowner’s Association, read the By-Laws to make sure you are allowed to rent it out. Many HOAs restrict the percentage of units that can be rented. Another reason to avoid investing in condos.

Did You Over-Improve Your Home?

Similarly, you will find it harder to realize a positive cash flow if your home is overly improved. That’s because you will not be able to charge a higher rent despite having higher maintenance costs. Alternatively, as Ownerly mentions, if you try to price higher to reflect the upgrades, it will take much longer to rent.

Some examples of over-improvements include:

- Jetted Bath Tubs

- Marble Countertops

- Swimming Pools

- New Windows

- Extensive outdoor landscaping

- Oddly planned additions

- Converting bedrooms to another use (home office or gym)

- Personal Customizations

It’s best to avoid these non-value add improvements if you think you might want to rent your home someday.

What Other Expenses Should I Plan For?

The general rule of thumb is that your rental operating expenses will be about 50% of your rent. It’s commonly referred to as the 50% Rule. This excludes your mortgage Principal and Interest.

You can use this as a very quick guideline but I strongly encourage you to go deeper because every home is different and yours may have some unique factors that change this factor significantly.

Take some time now to work through the following list to estimate operating expenses specific to your home:

Utilities

Do you plan to pay for these or pass them on to your tenant? See what the norm is for the local market.

General Maintenance & Repairs

This can range from 5% to 15% of rents depending on the age of the rental. Play with both ends of the range to see how sensitive your cash flow is to higher maintenance and repairs.

Insurance

You need to get an estimate for Landlord Insurance (DP3 Policy) which is typically more than homeowners insurance (HO3).

PRO TIP – Get Umbrella insurance to cover your personal assets as well. It’s inexpensive and will kick in if you exhaust your DP3 protection.

Property Management Fees

This can run anywhere from 8% – 12% or more of monthly rents. Save the money at first. You can handle one property if it’s local.

Even if you are not local but still want to manage your property yourself, there are options available. You don’t have to be present or hire someone to manage property showings. Check out Caretaker which offers a fully integrated self-showing and property management application.

Property Management Software

Even if you DIY manage your rental, you should use a property management software to collect rent, screen tenants, and track maintenance requests.

Luckily, there are a lot of great free online rent collection services. I like Cozy because it’s one of the few that is actually free for both you and your tenants to collect rent.

Property Taxes

Check your current property taxes and factor in 2% – 4% inflation annually. Don’t double count this if it’s already included in your mortgage payment.

Government Permits and Fees

This will vary depending on your location. Call the local housing authority or town hall and ask to speak with someone who can walk you through the registration process and fees.

HOA Dues

Take this from your condo documents if applicable and don’t forget to factor in inflation.

Professional Fees

I highly recommend you use a lawyer and a tax professional when you are starting out. They will help you navigate the complexities of converting your home into a rental. Costs vary widely but you can expect to pay them anywhere from a few hundred to a few thousand dollars annually depending on what you need them to do.

However, there are ways to save on legal fees. You can customize your own lease that suits your needs and then have a lawyer review to ensure it meets local requirements. The Landlord’s Guide To Writing Great Leases walks you through this process step-by-step.

Marketing Expenses

Most DIY landlords opt for free rental listing services such as Craigslist and similar sites. However, these sites can result in a flood of poor quality leads and scammers. I’ve compared the best rental listing sites to see which ones sent the most and best leads. Check it out to see which free sites are good and which site is worth paying for.

Alternatively, you may want to use a broker if you can share this cost with your tenant in your market. They will typically charge one month’s rent to find and place a tenant for you.

Tenant Screening

Depending on your market you may have to eat the cost of screening tenants because local laws prohibit you for charging tenants for this. Expect to pay up to $50 for each prospective tenant and professionally screen 2 – 6 tenants for each vacancy. Here are a few tenant screening services which provide the best value and service.

Mileage Expense

Don’t forget to track your miles for any rental related tasks. This is one of the most often-overlooked landlord deductions!

Office Supplies & Postage

There is a lot of paperwork when you become a landlord. This can add up quickly when you are first starting out.

Vacancy

Don’t get burned by using a simplistic rule of thumb. Vacancy rates are highly localized and often fluctuate. Rent Range includes a vacancy rate historical chart by rental property type for your zip code. Note the trend and make sure you give yourself a little buffer.

Capital Reserves

There will be major repairs at some point. You need to cover these from your monthly rent. You can estimate anywhere between 5% and 10% depending on the age of your rental and it’s current condition.

Learn more about Rental Operating Expenses and sign up for your free template you can use right now to see if your property will be cash flow positive. Note: “Net Income Before Taxes & Depreciation” is what others call “Net Cash Flow” in my template. (I used to be an accountant!)

Is There A Demand For Rentals In My Area?

A good rental property is one that is easy to attract great tenants. This can be boiled down to a few key factors that will help you understand if there is enough demand so you can easily rent your home.

Are There A Lot Of Renters In The Area?

According to the Census Bureau, between 30% and 40% of households are rentals.

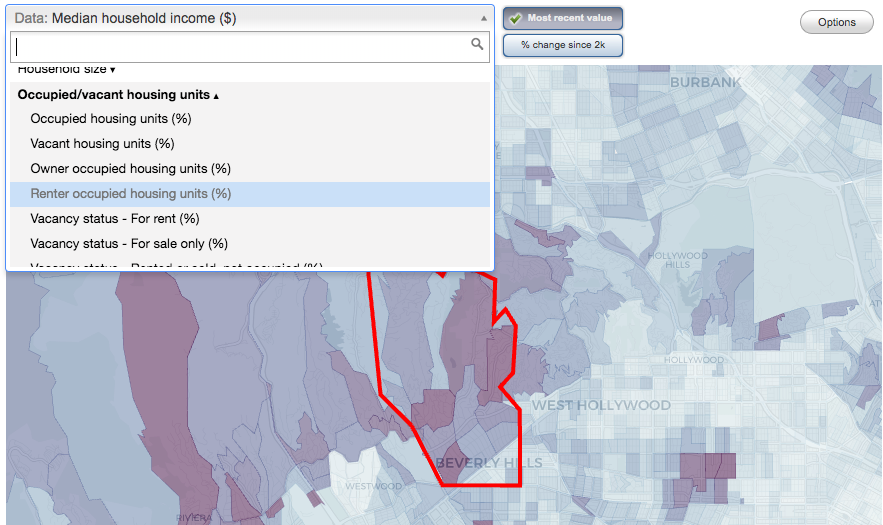

A good rental property has a steady demand of people looking to rent in the area. My rule of thumb is to look for an area that has a percentage of renters that is above the average, or about 35% nationally.

You can refine this target by looking at the data for your region. This will help ensure steady demand for your rental property.

Where Can I Find The Percent Of Renters In My Area?

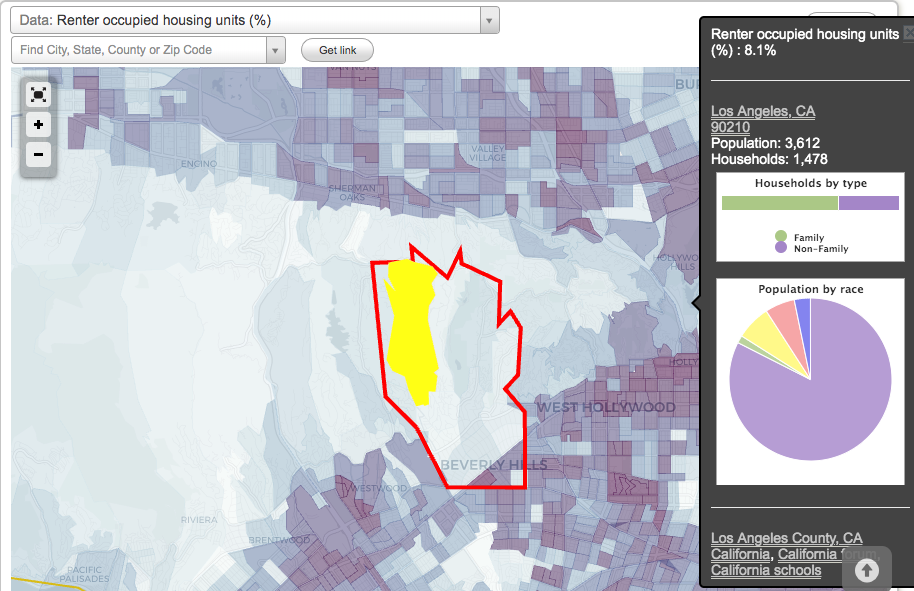

You’re probably thinking, “that’s great, but where would I find this information?”

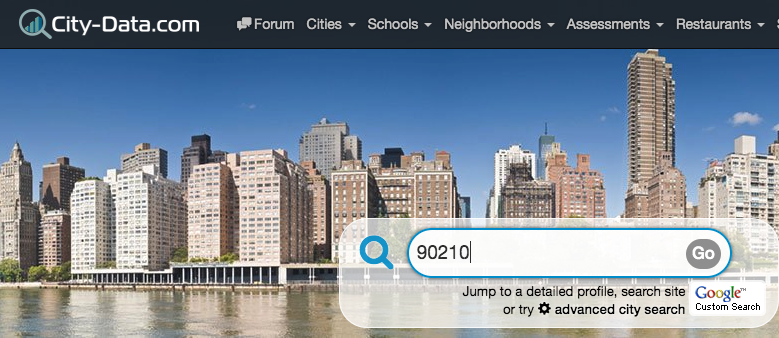

City Data

City-Data is a great resource that will help you find out almost any stat you could ever want to know about your town.

- Go to the main search bar and type in the zip code

- Scroll to the interactive map and select “Renter Occupied Housing Units %” from the drop down

- Click on the section of town you are located in

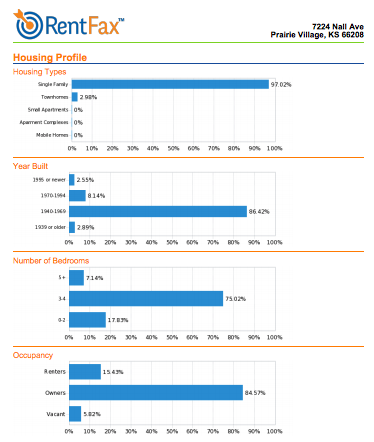

RentFax

Alternatively, You can get a comprehensive report sent to you immediately.

I use RentFax which aggregates a lot of the relevant information available publicly but into one convenient and easy to understand report.

Run the full Rent Package report to get everything you need as a landlord in one report.

In this “Housing Profile” excerpt above from a sample Rent Package report, you can see this zip code has 15.4% renter mix. In addition, you can see the mix of housing types, ages of homes and number of bedrooms.

See the full sample RentFax Rent Package report for more details.

The best thing about this report is you get much more information including Crime stats, Population Density, Public School rankings, and more. All of this will help you understand how desirable your neighborhood is to potential renters.

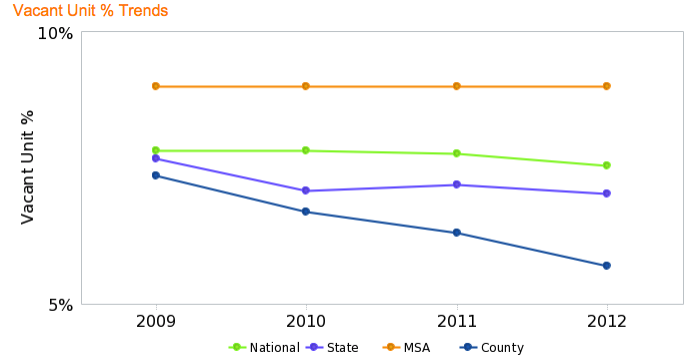

Vacancy Trends

In addition to estimating vacancy rates, it’s also important to take note of the trend. A steadily rising vacancy rate could indicate your property is in a neighborhood that is becoming less desirable for renters.

It’s important to compare this trend to the trends in the larger markets around your property. Are vacancy rates in surrounding areas declining while yours is increasing? This may be a major red flag.

The RentFax Rent Package report includes a historical trend for vacancy rates in your area. It also compares the vacancy rates to the national, state and MSA’s (Metropolitan Statistical Area). See the example above.

I also like Rent Range’s trend graph because it breaks vacancy rates out monthly so you can get a sense of seasonal trends within the last 13 months.

The bottom line is to use a tool like Rent Range if you want in-depth look at the local market rent and vacancy trends.

For more a broader overview of other factors that impact rental demand then use Rent Fax.

Both of them together will help you understand the desirability and profitability if you decide to rent your home.

PRO TIP – If you decide to use Rent Range, don’t forget to save money by signing up with the referral code AR25OFF.

Other Indicators Of Rental Demand

There are a few other things that will help you understand how desirable your area is when deciding if you should rent your home.

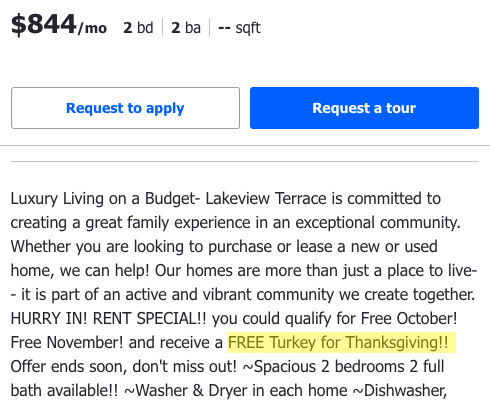

Rental Incentives

Take a look at your competition’s listings. Are they offering incentives like first month free or paid broker’s fees? If so, this could be an indication that the local market is experiencing a slump in renter demand or supply is too high.

Use a tool like Rent Fax (see above) to understand if this slump is just your area or if it is a broader market trend.

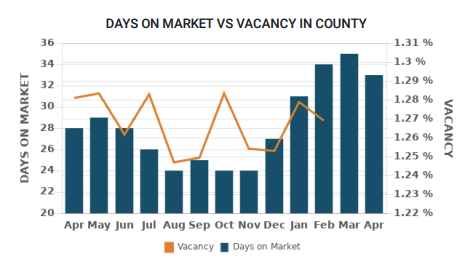

Days On Market

Another great indicator of rental demand is the Days On Market (DOM) metric. It measures the average number of days rentals have been listed before being rented.

RentRange includes a monthly trend in their rent analysis report. See the image in the “Vacancy Trends” section above.

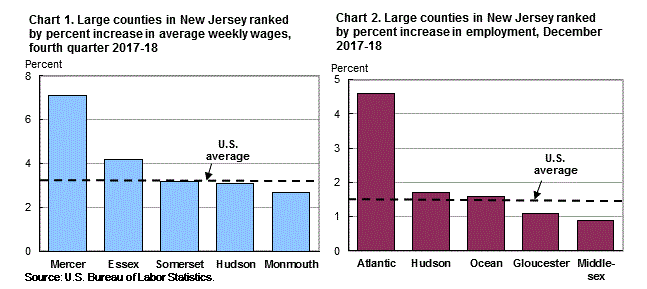

Job Market

Is employment in your area rising? How about wages? Rising employment and wages are strongly correlated to housing demand.

US Bureau of Labor Statistics

See where your county stands at the Bureau of Labor Statistics website.

Scroll down to the Regional Homepages section of the Home Page and enter your state. Filter to see your state’s reports on the next page.

Local Development

Your local government’s website is also a great resource to see what projects might bring in new jobs.

Google “Your town + development projects” and read through the top links. These will likely be the most recent projects under consideration in your town.

Will Someone Want To Rent Your Home?

You’ve run the numbers and realize your home could earn a positive cash flow as a rental and that your local area has strong rental demand.

Congratulations! You’ve decided to rent your home. Time to put up the For Rent sign, right?

Not yet.

Now you need to understand how your home stacks up against the local competition. In other words, you need to know why someone will someone will want to rent your home over other rentals.

Is The Location Desirable?

Where your home is located in your market will play a big role in determining how desirable it is to renters. Here are a few factors that make a rental location more desirable.

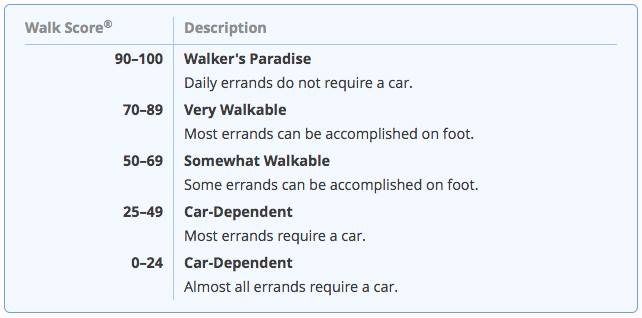

Walk Score

Zillow added the Walk Score several years ago. It’s a way to measure proximity to nearby amenities. The more amenities within walking distance, the higher the walk score for a neighborhood.

Transit Score

Similar to the Walk Score, the Transit Score measures how accessible public transportation is in a neighborhood.

It matters because tenants often don’t have cars and need a way to get to work.

See your home’s Walk and Transit scores here.

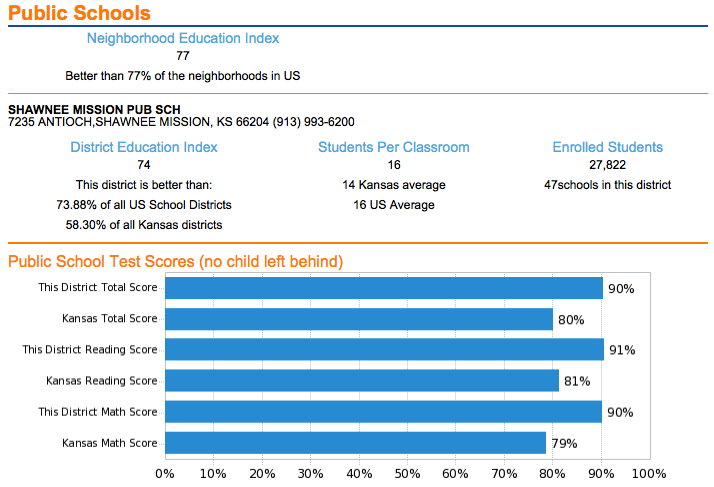

Schools

There are about 35M Households with children under 18. That’s about 28% of all households who need to live near a good school. If your home is the perfect starter home for a young, growing family, then you should look at the local school rankings.

You probably already know a lot about the local schools if you live in the area and have school-age children. If not, you can see how the local schools stack up against each other with GreatSchools.org. It’s a non-profit that ranks schools on a variety of factors including college readiness and test scores.

Rent Fax also includes a summary of public school test scores and education expenditures in their Rent Package report.

Local Amenities

Leverage your unfair advantage over non-local landlords who don’t know about the local amenities. How close is your home to local attractions such as parks, shopping, nightlife, etc.? What are the hot new restaurants? What new stores have opened up downtown? Is parking easy to find?

Take a trip to your town hall and pick up materials about the town. It will highlight the features they use to sell the location. All of this information will make for a great rental listing if you decide to move forward.

Busy Streets

This may seem counter intuitive, but busy streets attract more renters. It’s probably due to the fact that rentals on busy streets get more visibility. However, it may not be a great feature for couples with very young children.

Does It Have Amenities Renters Want?

Location is important but it isn’t everything when it comes to rentals. Your home has to have the features and amenities that renters need and want.

The Big Three

Renters will base their decision on which home to rent based on The Big Three:

- Price

- Location

- Size (Number of Bedrooms)

These are the primary factors that drive most of the purchase decision for renters in my experience. Most renters will not compromise on these three factors.

It makes sense. Would you rent your home if you couldn’t afford it, or if it was too far from work, or it couldn’t accommodate your family?

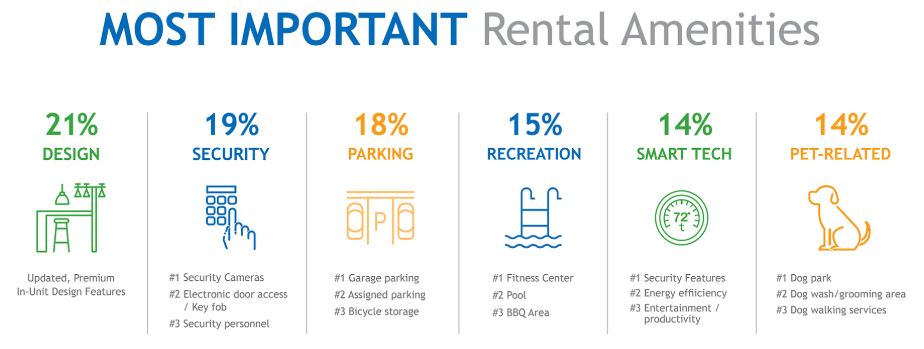

Top Amenities and Features Renters Want

Then there are the other property amenities and features that renters are looking for. These amenities will often tip a property in favor with a potential renter.

Common amenities and features renters want include:

- Pet Friendly (Could be the Big Four for Pet families)

- Washer Dryer In Unit

- Air Conditioning (location dependent)

- Security

- Dishwasher

- Updated Appliances

- Parking

- Closet Space

- Storage

- Outdoor Space

- Energy Efficiency

- Smart Tech (Energy and Security)

These vary by location so you need to look closely at your market to see what’s hot and what’s not.

Review Local Rental Listings For Clues

Spend some time reviewing rental listings in your neighborhood. What are the most common features in the listings? What features do the units that rent fast have that others don’t. A little research will quickly reveal what local renters are looking for.

How does your home compare? You can’t change The Big Three (You can change the price but you can’t change someone’s budget) so you need to focus on the rest of what your home has to offer. Highlight the features that matter most to renters in your area.

PRO TIP – Assess your property’s condition while reviewing its amenities. Use a comprehensive walkthrough checklist so you don’t miss anything.

Are You Ready To Become A Landlord?

Awesome! You made it this far.

You know the numbers work, that there is demand for your home as a rental, and which amenities will make your house standout against the competition.

Now you are ready to rent your home and become a landlord!

Before you go any further, I want you to ask yourself one more question:

Do I have what it takes to be a landlord?

You don’t have to answer that right away. Just think about it and when you’re ready, take my Landlord Mindset Quiz. This is the next step in becoming a landlord.

Conclusion

Deciding if you should rent your home can be tough. There are a lot of questions to answer but you can decide with confidence if you focus on the the three things that matter:

- Will it provide positive cash flow?

- Is there high rental demand in the area?

- Why will someone rent your home instead of someone else’s?

Do the research to answer these important questions and you will be able to make the decision to rent your home with the confidence of knowing that the numbers work and your home will have steady demand.

Whether you need to rent your home because of circumstances or want to turn it into an investment property to build wealth, I hope you found this Accidental Landlord’s guide to the decision making process helpful.

Before you go any further though, be sure to take the Landlord Mindset Quiz to see if you have what it takes to be a good landlord.

Want to Learn More?

Check out my book: The Accidental Rental. A Complete Guide to Converting Your Home into a Profitable Rental Property. Don’t miss your chance to build wealth through real estate. The Accidental Rental will show you how step-by-step!