Condos can make great homes, but can you rent a condo out? If you are considering turning your condo into a rental or even purchasing a condo to rent out, there are few things you need to know.

This article will take you through the important considerations and common restrictions of renting out a condo. These include:

- Legal and Regulatory Requirements

- Financial Implications and Profitability

- Homeowner Association Restrictions

- Mortgage Lender Restrictions

But before we cover these important considerations, let’s look at the pros and cons of renting a condo out.

Pros and Cons of Renting a Condo Out

Condos can be a good choice for first time homeowners, people living in high COL, urban areas, or empty nesters who downsize and don’t want the hassles of home ownership anymore.

But do condos make good rental properties? Here are some of the pros and cons of renting out a condo.

PROs | CONs |

Shared costs | Surprise assessments |

Less maintenance | Rising HOA fees |

Attractive rental option | Extra HOA fees |

Lower insurance costs | HOA restrictions |

Costs less than a SFH | Harder to finance or refinance |

Slower appreciation than a single family home | |

Hostile HOA boards |

Pros of Renting a Condo Out

Shared Costs

Condo owners pool their expenses. This can significantly reduce the sticker shock of major capital repairs. If your single family home needs a new roof, it will cost you upwards of $10,000 to $20,000. However, even though a new condo roof might cost $50,000, spread across 10 or more units, your cash outlay will be significantly lower.

Less Maintenance

Most maintenance issues are handled directly by the HOA. That’s because they are responsible for maintaining the common areas which include the halls, entryway, utilities, laundry room, yard, amenities, etc. This means less maintenance for you or your tenant versus a single family rental property.

Attractive Rental Option

As mentioned, there are a number of renters who find living the condo life to be very appealing. You can expect high demand, especially in urban areas where SFHs are harder to come by.

Lower Insurance Costs

Insuring a condo will cost much less than insuring a SFH all else equal. That’s because you only need to cover your property from the “walls in.” The HOA will cover the common areas of the property, including your outside walls.

PRO TIP – always require your tenant to carry Renter’s Insurance to cover their personal belongings as these will not be covered under your landlord policy.

Condos Cost Less

You may be thinking about buying a condo to rent out because they are generally much less expensive than buying a single family home or a multifamily home. However, be sure to consider the full costs of condo ownership before you decide.

Cons of Renting a Condo Out

Surprise Assessments

As a condo owner, you are responsible for your fair share of capital expenditures. This could be for a much needed new roof as described above or for something less necessary like new decorations and carpets for the common areas. These are usually covered via a special assessment if there are insufficient reserves. As a real estate investor in a condo, you can be caught off guard if you do not plan for these special assessments.

Rising HOA Fees

Condo HOA fees tend to rise annually. This is partially because of inflation, but it’s also because no one cares as much about rising costs when the costs are shared collectively. Rising insurance, property taxes, property management fees, etc. can all be negotiated and reduced with some effort. Most HOAs do not put in the effort to keep costs as low as possible. This results in steady HOA fee increases that often far outpace inflation.

Extra HOA Fees

HOAs often impose extra fees for investors. These can include a leasing fee, move in-out fee, tenant screening fee, and more. I’ve seen some very creative fees imposed by HOAs that are designed to only impact landlords and not resident owners.

HOA Restrictions

In addition to extra fees on landlords, condo HOAs often impose other restrictions including limiting the number of rentals allowed in the property and having final say on your tenant selections.

Harder to Finance

Condos are generally more difficult to finance. This is due to the special rules imposed by Fanniue Mae. More on this below.

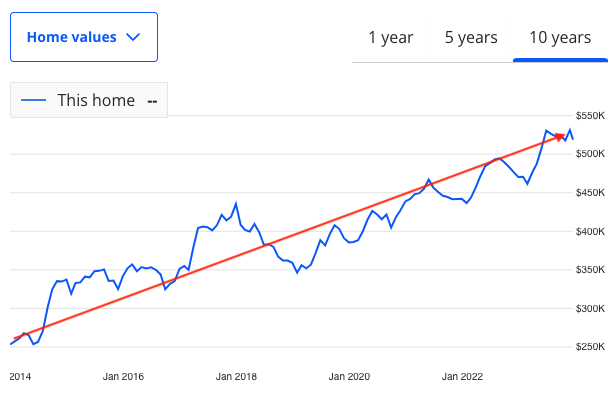

Slow Appreciation

Condos appreciate much slower than single family homes. If you are purchasing a condo to rent out and you are relying on appreciation to make it profitable for you, then check out this comparison of a condo and a single family home appreciation over the same period.

Be sure to factor in a MUCH slower appreciation or don’t rely on it at all in your financial evaluation.

Hostile HOAs

HOAs generally do not like real estate investors. They view them as devaluing the property by renting to low quality tenants, ignoring community issues, and avoiding maintenance. For these reasons, some HOA boards can be downright hostile to landlord owners. They will impose rules and restrictions designed just to inhibit your ability to rent the condo.

HOA’s are governed by the condo charter which often gives them broad powers. Fighting an HOA is often a losing battle which can ultimately result in a foreclosure of your property in extreme cases.

PRO TIP – It’s a good idea to get a position on the HOA board. It gives you visibility to issues, potential assessments, and advocate for the landlords in the property. You may not fully avoid some of the cons discussed above, but you may be able to mitigate their impact somewhat.

Important Considerations Before Renting Out a Condo

Renting out a condo, just like any other home, is a big decision which requires a lot of planning and analysis. (My guide, The Accidental Rental, walks you through the process in detail.) In order to make an informed decision about owning a condo rental property, let’s dive deeper into the specific restrictions and complications that need to be considered as well. Before renting out a condo you should consider the following points in the next sections.

Legal and Regulatory Requirements

Every jurisdiction has state and local landlord-tenant laws, but some jurisdictions have special laws covering condominiums and co-ops. It’s important to know ahead of time if your property will be subject to these special laws and restrictions.

Is It Legal to Buy a Condo to Rent Out?

Yes. It is generally legal to buy a condo to rent it out. However, the building HOA or the local jurisdiction may restrict this to some degree, so you need to be aware of this before you invest.

State-Specific Requirements for Renting Out a Condo

Search for Your State Condo Laws

Many states have separate laws that govern condominium life. For example, The Davis-Stirling Common Interest Development Act (Cal. Civ. Code §§4000 – 6150), governs HOAs in California, the Illinois Condominium Property Act (ICPA), and New York by Article 9B of the Real Property Act.

These laws define the powers and limitations of HOAs. Run a simple Google search for “Your State + Condo Law” to see what the HOA can and cannot do with your property.

Rent Control Restrictions

Condominiums are sometimes located in urban areas with housing shortages that are subject to local rent control laws. Condo or not, you should always be familiar with the local rent control laws in your area.

HOA Rules

Some states specifically require you to provide a copy of the HOA rules to your tenants. Failure to do so, could subject you to fines or make you liable for their actions.

PRO TIP – Always add a lease provision that the tenant is responsible for HOA fines otherwise it may not be allowed by law or a judge.

Financial Implications and Profitability

Before buying a condo to rent out or deciding to convert your personal condo into a rental, it’s important to understand the financial situation. Here are some important things to know about condo financials.

Condo Revenue Potential

Condos can have high revenue potential due to their desirable location. Condos and co-ops tend to be located in the suburbs of metropolitan areas. According to HUD, multifamily units in high rise buildings account for nearly half of all condos and co-ops. The walkability and proximity to amenities make condos an attractive investment from that perspective.

Compare the rents for local similar condos to get an initial estimate of what your rental might go for on the market. Pay close attention to condos that are close by and have the same number of bedrooms, roughly the same square footage, and are in the same condition as yours.

PRO TIP – Use RentRange to get an accurate estimate of the current rent rates. It tends to be more accurate because it takes into account actual rent rates, not just asking rents. You can get a discount on these reports if you sign up here.

Condo Operating Costs

Managing a condo rental is different than a single family rental home. As mentioned in the pros and cons above, there are some cost savings and some extra costs that you need to fully account for when determining the true profitability of a condo rental.

Condo Insurance

Insuring a condo requires a different type of insurance policy and coverage. On the one hand, you are only covering the interior structure and some personal property such as appliances and fixtures. This significantly reduces your coverage requirements because you are not covering exterior items such as the siding and roof.

However, the premium you pay for what you do cover will be higher than with a standard homeowner policy. That’s because the property is non-owner occupied. Insurance companies will require you to carry a Dwelling policy or an HO6 policy with a tenant rider which tends to be more expensive than an owner-occupied policy.

The bottom line is that your insurance costs will generally be lower, but not by a significant amount.

HOA Dues

If you are converting a condo that you’ve owned into a rental, then you know that you have to pay HOA dues. These dues cover the cost of maintaining the building infrastructure, utilities, insurance, property management, and the reserve fund. Additionally, you are probably aware that HOA dues are always increasing. Sometimes the increases are gradual and manageable, but other times they come in large increments. The more amenities and common areas, the higher the HOA dues will be.

HOA Reserves

A well-managed HOA will have a sizable reserve fund that should be used to cover emergency costs such as central HVAC repairs or damaged exterior. This reserve should be funded from the HOA dues but it is sometimes funded through special assessments.

Also, when you buy a condo, you may be required to contribute to the condo reserves. This is a lump sum you pay up front as a contribution to the reserve funds of the association.

PRO TIP – Pay special attention to the financials of the HOA if you are buying a condo to rent out. If the reserves are low, or non-existent, you should expect to be hit with a sizable bill sometime in the future. Also, if the association has any outstanding debt, you will be responsible for a portion of that debt. Try to negotiate a credit at closing to cover the outstanding debt.

Special Assessments

Condo boards often vote to make building improvements or repairs. These one-off expenses are usually paid for by a special assessment. It’s an unavoidable fee due immediately to fund the project. If you are unable to pay, the HOA can impose penalties and obtain a lien on your condo unit. While many assessments may bring value to the building, many will not. I once had a board vote to add a deck to a bottom floor unit. How does that help the value of my unit?

As mentioned above, if the association cannot cover the cost of an emergency repair from its reserves, then the association must either collect the necessary funds from the owners or take a loan if that is allowed. Loans are unusual and are difficult to get so this is usually collected via a special assessment. Most HOA bylaws don’t require a vote for emergency expenditures, so there is little you can do to avoid this.

PRO TIP – Before buying a condo to rent out, take note of any deferred maintenance such as run down common areas, peeling paint, leaking roofs, etc. If there is no reserve to cover this, you will be paying for it in the form of a special assessment at some point in the near future.

Investor Fees

In addition to the normal HOA dues, condo associations often impose special fees and dues on rented units. These often take the form of security deposits, registration fees, surcharges, administrative fees, and move-in / move-out fees. The monthly HOA dues and extra fees can easily add hundreds to the monthly costs to the landlord making the rental unprofitable (often by design). Check your association bylaws before renting out your condo to see if there may be new fees you will owe.

HOA Rules and Restrictions

Some Homeowner Associations may impose special rules and restrictions on rentals in the building. These can range from restricting the number of rentals allowed in the building to requiring the tenant to be approved by the HOA.

Here are a few examples of restrictions to look out for before you rent out a condo:

- Lease Terms: HOA’s may require specific language or terms in your leases

- Use Restrictions: HOA’s may restrict how rental units can be used, such as limiting short-term rentals, prohibiting commercial activities, subleasing, or even the maximum number of years it can be rented

- Rental Caps: Restrictions on the number of rentals allowed in a building (often under 50%)

- Approval: HOA’s may require written approval to rent your unit

- Paperwork: You may be required to submit a copy of the lease agreement to the HOA

- Tenant Screening: Tenants may be subject to HOA approval

- Insurance Requirements: HOA’s may require you to carry a specific type and amount of insurance as well name them as an additional insured party

- Penalties: HOA’s may impose penalties or take legal action against landlords who fail to adhere to rental restrictions or violate the rules.

It’s essential for condo owners and investors to review the HOA’s governing documents, including the Declaration of Covenants, Conditions, and Restrictions (CC&Rs), Bylaws, and Rules and Regulations, to understand any restrictions or requirements related to renting out their unit. I’ve heard horror stories where investors have been unable to rent a condo they bought because of these restrictions. Do your homework!

You may think that some of these restrictions are not fair or legal. In fact, these restrictions are sometimes contested, but they are often upheld if they are found to be reasonable, in good faith, and in the best interests of the HOA members. That’s why it’s so important to know what your condo restricts before deciding to rent out your condo.

Mortgage Lender Requirements

If you are planning to buy a condo to rent out, pay attention to your mortgage lender’s requirements. Many lenders are hesitant to loan to condo investors. Fannie Mae has special rules when it comes to condos that could make getting a loan harder. Your lender will want to understand the financial stability of the HOA, the details of special assessments, and any deferred maintenance.

Even if you already own the condo, your lender could restrict your ability to convert it into a rental property. Check your mortgage note to see if there are any restrictions. There is often a requirement that you live in the property for a minimum period before you can convert it into a rental.

Typical Problems with Condo Rentals

In addition to the issues detailed above, there are a few other problems that typically arise in condo buildings that you may encounter.

Hostile Condo Boards

Some Condo boards can be downright hostile to landlords. They feel that you are just an investor looking to profit and you must have deep pockets, so they feel justified when imposing special fees.

My advice if you find yourself facing a hostile condo board is to join them to have a say on issues that will impact your investment. Meet the board members and convey to them that you are just as vested as them (if not more!) in maintaining a great living environment for your tenants and their neighbors. Reassure the board that you have a strict process to make sure only quality tenants will live in your condo, and you will quickly deal with any issues if necessary.

Tenant-Neighbor Issues

Living in close proximity to neighbors in a shared building can sometimes lead to potential conflicts or disputes over noise, parking, maintenance responsibilities, or other issues. Be prepared to act as an arbitrator between your tenant and their neighbors. Try to resolve any issues before the HOA needs to get involved.

Damage Caused by Neighboring Unit

It’s not uncommon to have a rental property flooded or damaged by a problem in a unit above yours. I’ve had my condo rentals flooded on a handful of occasions because of a broken water heater or bad plumbing above. Finding the source and determining who’s responsible is a pain. Owner’s may try to blame the association or their own tenant. Be prepared to deal with an owner who doesn’t want to take responsibility.

Extra Steps to Follow Before Renting Out a Condo

In addition to the normal preparation for renting out a home you own or invested in, there are a few extra steps when it comes to renting out a condo.

- Gather the Homeowner Association’s governing documents

- Review and understand any HOA restrictions on your ability to rent your unit

- Check with your lender that you are allowed to convert your unit to a rental

- Prepare a lease that includes special condo-related provisions (see my Lease Guide for more on this)

- Inform your tenant of the HOA rules and their responsibilities

- Ensure you and your tenant have the appropriate insurance coverage

Following these extra steps will help ensure your condo rental is legit and avoid any unpleasant surprises.

Want Help Renting Out Your Condo?

If you are thinking about renting out a condo and aren’t sure where to start, The Accidental Landlord book can help! It’s a complete, step-by-step guide to converting a home into a rental property.

Inside you’ll find:

- The mindset and skills every successful landlord needs

- How to assess your home’s market potential and set rents

- A complete checklist to get your home rent-ready

- Red flags to watch for when screening tenants

- How to write a lease that protects you

- How to collect rents effortlessly

- How to maintain your rental and keep good tenants

- A rental property financial and tax guide

- An overview of Fair Housing laws and how to handle evictions

- State-specific guides, legal form templates, and checklists

Plus, for a limited time you’ll get 14 free bonuses including printable checklists, editable legal forms, and more with your purchase.

Discover how you can become a landlord with minimal stress and maximum profit today!

Conclusion

While buying a condo to rent out or converting your condo into a rental may seem like an attractive option, there are many challenges unique to condos. Despite the higher rent and desirable location condos sometimes enjoy, I believe most novice investors should avoid buying a condo to rent out. There are many more risks than potential rewards.

However, if you know what to look for and plan accordingly, renting out a condo can be very lucrative and rewarding. As always, seek professional advice if you are in doubt or unsure about how to proceed.