Are you looking to diversify your real estate investments? Do you have some extra cash from profitable rentals that you are looking to put to good use? Have you thought about becoming a hard money lender but feel it’s too complicated?

I know exactly how you feel! I’ve been a landlord for nearly 10 years now and I’ve built up a sizable pool of equity. Instead of buying another rental when prices are high, I’ve been looking into hard money lending as a way to invest those funds for higher returns.

But I was a little intimidated by the whole process. It seemed like it was too complicated and too risky. Instead of giving up and accepting a measly rate of return from my savings account, I decided to learn more about hard money lending.

In reality, becoming a hard money lender is not very complicated. With a little knowledge and some tips, you can easily earn 8% to 12% return or more on your cash without virtually any risk to you.

In this article I will explain what hard money lending is, its advantages, how hard money lending works and what mistakes to avoid.

What Is A Hard Money Lender?

A hard money lender is any individual or group of individuals that loan their own money privately on a short-term basis and secure their investment with real property. Let’s break this down a bit further:

- It can be a person or company making the loan

- They use their own funds, not deposited funds like a bank

- Typical loan term is short, often a year or less

- The loan is collateralized by a mortgage – an interest in the real property

The term Hard Money Lender is often used synonymously with Private Money Lender but there is one vital difference. If you are loaning money on the basis of someone’s credit worthiness without an asset to collateralize the note, then you are simply a private money lender.

By contrast, a Hard Money Lender secures their investment with a lien on real property and doesn’t rely entirely on the credit of the borrower to repay the loan.

Advantages Of Being A Hard Money Lender

You are probably already familiar with some of the advantages of becoming a hard money lender if you are seriously considering becoming one. But if you are just getting started, here’s a list of the key advantages of becoming a hard money lender.

Higher Returns

The biggest advantage of becoming a hard money lender is the fact that you will be able to realize higher returns on your invested capital versus a savings account. Typical loans yield between 8% and 12%, often higher.

Diversification

Expanding into paper investments is a great way to boost returns on your real estate business without buying more property.

Liquidity

Notes are investments that can be sold more easily than the underlying property. However, you should expect to receive less than your full principal depending on the going rate of return and the underlying characteristics of your note.

Assets Utilization

Becoming a hard money lender allows you to invest in real estate deals on a short-term basis when you don’t have a deal to invest in yourself.

Low Hassle Cash Flow

Hard money loans provide for a steady cash flow without the usual hassle of managing a tenant or property manager.

How Does The Hard Money Lending Process Work?

Finding A Borrower

Unless you are an established Hard Money Lender or advertising as such, you will need to reach out to your network of investors to see who’s got a deal you can fund.

The best place to do this is at your local Real Estate Investment Club. Here is a great directory of local clubs in case you don’t know of any in your area. Reach out to the club manager and ask if the members typically use Hard Money Loans and if it’s ok to attend the next meeting.

Size Up The Deal

Once you’ve found a local investor who needs a hard money loan it’s time to size up the deal to see if it makes sense for you to invest in.

Establish Equity

How much equity does the borrower have in the property? As a Hard Money Lender you should be looking for at least 30% equity. This means that the borrower is borrowing no more than 70% of the After Repair Value of the property. For example:

$85,000 purchase price,

$15,000 in repairs,

$150,000 After Repair Value

Loan for $100,000 = LTV of 67%

Assess The Borrower

Do they have a local reputation for making great deals? Have they gone through bankruptcy? Are they new to the business? Is this their first deal? Do they have an excellent track record of timely payments? You are not necessarily concerned with their personal credit history because your loan will be secured by the property. Instead, you are concerned with their reputation as an investor.

Negotiate The Terms

Ask the borrower what terms they are expecting. Hard Money Loans are typically short-term, 6 months to 1 year. Some borrowers are looking for a multi-year loan, up to 5 years but they will likely refinance and pay off your note early.

Interest rates can vary widely depending on the local market, the risks involved, the length of the loan, etc. Be sure to know the going rate in your market. You may need to offer a slight discount until you establish yourself as a reliable lender who can close quickly.

Kick The Tires

Now it’s time for due diligence.

- Ask the borrower for their list of comparables. How do they stack up to your list?

- Obtain a list of repairs needed and an inspection report which should include a termite and oil tank inspection (if prevalent in your area)

- Have an After Repair Value appraisal prepared by a professional appraiser

- Inspect the property to verify the repairs needed and value if possible

- Obtain Repair bids

- Insist the borrower obtain title and home insurance naming you specifically

Close The Deal

Review the loan documents and wire the funds to the escrow agent. Be sure to use an experienced lawyer, especially if this is your first transaction.

Service The Loan

A simple interest-only loan with a balloon payment can be managed directly by you. However, if your loan is more complicated, you may want to turn the loan over to a servicing agent who prepares amortization tables, monthly statements and collects the payments.

PRO TIP – Be sure to set a minimum period of at least 2 -3 months to make the loan worth your efforts.

3 Hard Money Lender Mistakes To Avoid (That I almost Made)

1 – Not Being Secured In The Deal

This is the biggest mistake you can make. And I almost made it on my first deal!

This is the biggest mistake you can make. And I almost made it on my first deal!

I was so eager to close on a lending deal that when I received the documents from the borrower’s lawyer I almost didn’t even realize that I was making a Private Money Loan and not a Hard Money Loan!

As mentioned above, when you have no collateral and you simply rely on the borrower’s promise to pay you back, then you are merely a Private Money Lender. The documents I received didn’t include a Mortgage, just a Promissory Note. Luckily, this turned out to be a miscommunication between the borrower and their lawyer. In the end, I did receive a mortgage in addition to the promissory note.

Another way you can end up unsecured is by not having enough equity in the deal. A general guideline is to never loan more than 70% of the After Repair Value. Another way to think about this is to never loan more than you would actually pay for the property in its current condition. That is essentially what you are doing in some respects.

If the deal goes bad, you have essentially bought the property for the outstanding loan amount. Ask yourself, would I make this purchase normally?

Let’s Make A Deal

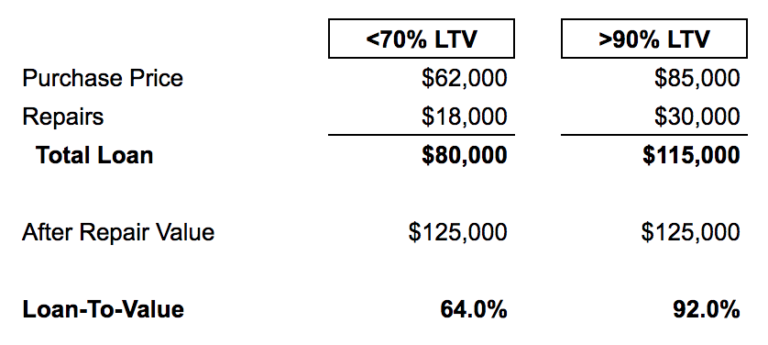

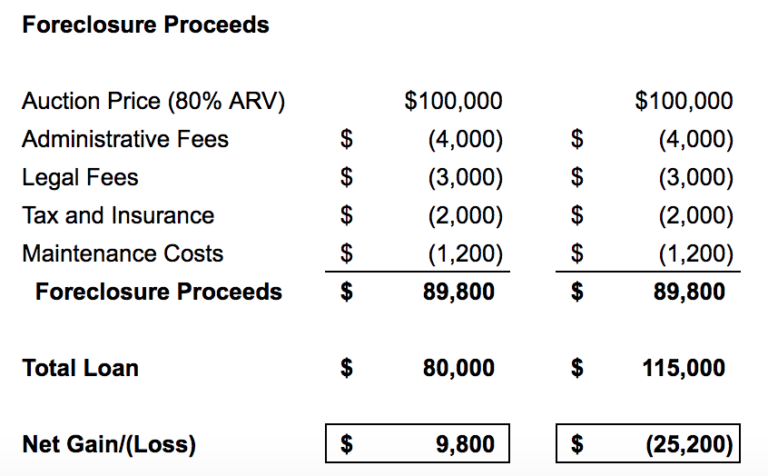

Here’s an example of two hard money loans. The first loan is well-secured with a LTV <70%. This was my first hard money loan deal. The second loan is less secured with a LTV >90%.

See what happens when something goes wrong and the borrower defaults:

Assumptions:

Assumptions:

- Property will appraise for $125,000 After Repairs (ARV)

- All funds loaned are spent and all repairs are made

- Property will sell for 80% of ARV at auction

- I will incur about $10k in holding costs and fees to foreclose

I’ve estimated the various costs of foreclosing on the property (although I’ve never done this before) for illustration purposes. Your situation will vary according to your local market. Note that legal expenses are much higher in judicial foreclosure states.

As you can see, my first deal has about 64% LTV so there is some cushion in case I had to foreclose to collect on the loan. After foreclosure, I estimate that I would come out with an additional $10k.

In contrast, the second deal is highly leveraged and there is not enough equity to cover your losses. You are out -$25k after collecting on the foreclosure.

2 – Decimating Your Wealth

The ancient Romans punished mutinous armies by executing every tenth soldier. They believed this was the best way to punish the defecting army without suffering a catastrophic loss of soldiers.

That’s because they knew that if an army lost more than 10% of its men, then they couldn’t win a battle. The loss would be too devastating to recover from. This is the origin of the word Decimate.

You should think of your savings as soldiers in a battle. You never want your savings to be decimated!

Hard Money Lending should be a way to diversify your investments. You should never be investing all of your liquidity in any one deal. Never loan more than 10% of your net worth. You can recover from a loss of less than 10% of your net worth in your lifetime. Any more than that could be unrecoverable.

I was nowhere near this 10% threshold in my deal but I was stretching what I had available in liquid assets. I was able to work with the borrower to finance a smaller loan that gave them what they really needed and still gave me a cushion in case of emergencies.

3 – Not Insisting On Title Insurance

The only way to ensure the mortgage is worth anything is to be named on the title insurance! Without this, you could find your collateral is not actually yours when it comes time to collect.

Why do you need title insurance?

You get paid by either (1) the borrower paying you back according to the promissory note terms or (2) foreclosing on the mortgage and collecting the funds at auction.

Even though your borrower may have cleared title to the property, you could still be surprised down the road should someone come forward with a claim not previously identified.

If you have to foreclose on the property, you could find that not all liens were discovered and in fact, you do not have good title to the property. You will need to clear the outstanding lien which will take time and money. Title insurance protects you from this scenario.

I have to confess!

I was about to knowingly make this mistake! Because I was working with a very trusted investor who was mentoring me, I considered waiving the normal title insurance requirement. Do not do this yourself!

Always insist the borrower pay for title insurance!

In the end, they agreed to add an endorsement for the mortgage policy and to name me on the title insurance.

PRO TIP – I recommend having an experienced lawyer review the title commitment to ensure you are properly covered. Tracing ownership is a complicated process and mistakes often happen. A good real estate attorney is a small investment for significant peace of mind.

Further Reading

I was actually inspired to look into hard money lending by an interview that Coach Carson had with Dyches Boddiford, an expert in real estate paper and hard money lending. You can read more here or you can hear the full interview with Dyches and Coach Carson on Youtube. Be warned, it’s long and full of awesome tips!

Conclusion

If you are looking for ways to earn excellent returns on your rental profits you might want to consider becoming a hard money lender. Don’t let fear keep you from growing your business. You will see that it’s actually an easy process once you do a deal.

The advantages of hard money lending far outweigh the risks if you know what you are doing. Put your assets to use with a safe, liquid, high-yielding investment without ever having to answer a tenant call!

Understanding the process is the key to successful hard money lending. Don’t make the killer mistakes I almost did.

- Secure your loan with a mortgage or else you are simply a private money lender who relies on the credit worthiness of the borrower to repay the loan.

- Don’t loan more than you would pay for the property yourself. If the borrower defaults, this is essentially what you have done.

- Don’t invest all of your money soldiers at once or in any one loan. You may not be able to recover from a bad investment if you loan more than 10% of your total net worth.

- Insist on title insurance to protect your interest in the property. Without clear title, you may find you do not actually have the collateral you thought you did!

What do you think? Is Hard Money lending a good investment or is it too complicated and risky? Leave a comment and let me know your thoughts.

Save Money With My Free Landlord Tips!

Sign up today for the monthly Accidental Rental newsletter for access to more money saving tips! When you sign up, you will automatically receive my latest free gift designed to help save you money and become an awesome landlord.

This is a very informative article and puts the issues in a very understandable format.

I am considering making a hardmoney loan via an experienced hard money loan person in Washington State – not with cash but with my self-directed IRA.

Glad you found it helpful!

I’ve thought about using an IRA but haven’t looked into it much. I know there are a lot of special rules and you need to make sure you can trust the custodian but they can be a great way to invest in RE. Good luck!

What company are you using for your SIRA? I have found 3 but would love a recommendation.

I don’t see a print version on your articles. Am I missing something??

Thanks for stopping by!

I don’t think that’s an option on the website. Sorry. Try saving it as a PDF and removing the headers and footers. If that doesn’t work, use the contact form and let me know which article you are interested in. Thanks.

I enjoyed reading your article , I have never done hard money lending but i’m looking to learn more about this…. I have $100K to work with and i’m trying to figure out a way that i can make money off this and not invest it in the stock market…. I would really like to know more on how to get started and how to find people who are looking for a hard loan, i’m thinking of loaning no more than $10K to each person…

Thanks!

Join a local REI club. You will quickly learn who are the local players making the most deals. They will be looking for money all the time. That said, you probably won’t get too many interested in a $10k loan because it’s not enough to do a deal. Also, you want to work one on one with an investor. You want to avoid having too many other people involved in your deal.

You might want to check out crowdsourcing REI funds. Here’s a good review of Fundrise from IdealREI. You can start investing for very little cash but the fees will eat into your returns. Either way, do your due diligence before you invest. Understand how you are secured in your investment (if at all)! Good luck!

Hey Domenick

I am just reading your article and notice it’s dated 2019, do you recommend any new crowdsourcing? Have you heard of fund that flip? I am also taking your advice and joining my local Real Estate Investment Club since I am starting to get into hard money lending as well.

TBH I haven’t focused on lending recently as I’ve shifted to investing in syndications and JVs but Fund that Flip looks interesting but I don’t know much about it. I would just understand how you get paid back and how you are protected before investing any funds with them. Let me know if you decide to invest and how it turns out. Always good to share new investing resources!

Hi Domenick,

First this article is great!

I have found it very hard to find and vet syndications. Mind sharing your syndication info? If its here on your site, I seem to have missed it, sorry.

Last, What is JVs? Thanks in advance.

Thanks!

JV = Joint Venture. It’s when a few partners get together and share the responsibilities.

I don’t act as a syndicator/sponsor myself but I can message you to put you in touch with others.

Hello Laina!

What city are you in? I live in Indianapolis and our housing market is booming. Many are moving out of IL and moving to IN as our cost of living is far more reasonable than what IL is doing to their people. I’d love to chat. Eric@zeedykremodeling.com

Is having an NMLS MLO license necessary to do hard money lending?

Great question! This is a complicated area and depends on where you live, what types of loans, etc. I suggest talking with a local established HML and attorney who specializes in this area to get the best advice.

I want to sign up for your monthly accidental rentals

Thank You very much.

Great Info!!

I am retired with a completed fix and hold project that went well under my belt. I am now looking to continue the success as a HML since i am having a hard time finding a flip. All the info was great, but your tips on securing the loan title insurance was enlightening to me. Thanks, much success.

Awesome! Glad it helped.

Hello. How do you determine the ARV? There are several method, aren’t there?

There are many ways to estimate the ARV but they all involve finding comparable properties. For SFHs you can find current comps on Zillow or the MLS if you have access. Compare your property to the most recent comparable sales and make adjustments for updates, number of baths, amenities, etc. to arrive at an estimated value for your property after you make the planned repairs.

For Multifamily homes you need to find the right cap rate. There usually aren’t too many recent comparable sales of those.

You can refine your analysis endlessly so don’t get overwhelmed. It’s only an estimate. You just want to make sure there is a high degree of certainty that there is enough equity in the deal for you to get your money back should the deal go bad.

Thank you, Domenick.

I’m looking for a 4th opinion on a HML deal I am closing on. This is my 1st deal and I am apprehensive about it. I’ve spoken to an attorney, will talk to a REI colleague who has 37 doors, chatted with a colleague who has had negative experience in this market. So a final, independent opinion, from a person “off the street”would be great.

Would you know someone or would you provide your own opinion? I want to pay for your time.

If so, how to reach you?

This is the due diligence phase of the deal and funds aren’t yet transferred. to borrower Used your calculations here: have LTV = 70%.

-Tim.

Hi Eric. I’d like to get in touch with you. Looking to enter the IN state market. How to reach you? -Tim.

Thank you for taking the time out to provide detailed content. I am currently taking on the responsibility of project manager in creating a hard money loan company in Georgia. I have absolutely no experience in real estate but tons of experience in business development. Right now I am in the research phase, making sure that all my ducks are in a row. This article really helped me! I appreciate you.

Thanks Tiff. Glad it helped!

Domenick, You’re A Blessing In Disguise!

Starting My Journey, As A HML/Cash Flow Investor!

Great Intel! Extra-Informative! Appreciate The Read.

Continued Success, To Each And Every Endeavor.

Sincerely,

Ty

Thanks for the kind words Ty. Congrats on starting your investing journey and best of luck to you!

Great info. I’m planning to use my SDIRA for HML. I’ve used HML in the past on some fix & holds so plan to use their format, but this info was a great intro on the basics.

Thanks for the comment!

Great information, even as a fix and flipper I used this as a check list to do my due diligence and be ethical while borrowing. Thank you very much.

Awesome! Thanks for the feedback.