If you’ve read my articles or books, you know my focus is on maintaining and holding rental properties for the long term. However, I’ve recently started thinking it might be time to sell a property or two. But what about the tax implications? The thought of paying all of those taxes has usually stopped me from even considering selling a rental.

That’s why I started looking into 1031 exchanges. So-called 1031 exchanges get their name from the section of the tax code that allows real estate investors sell their properties and delay paying any taxes, sometimes indefinitely. It’s a great way to trade up your real estate portfolio, but 1031 exchange rules can be very complicated.

I suspect many of you are in a similar situation, so I wanted to put together this brief guide to 1031 exchange rules for real estate investors. In this article I will cover:

- Benefits and downsides of 1031 exchanges

- An overview of the 1031 exchange rules

- Timelines for 1031 exchanges

- Illustrate the tax implications with an example 1031 exchange

- Show you how to avoid common 1031 exchange mistakes

But first, let’s get started with a brief overview of 1031 exchanges in real estate deals.

Disclaimer: Everybody’s tax situation and every 1031 exchange is unique. This information is intended to only provide an overview of 1031 exchange requirements. This is not tax, financial, or legal advice. You should always discuss your situation with a tax and/or legal advisor.

What is a 1031 Exchange?

A 1031 exchange, named after section 1031 of the Internal Revenue Code, is a tax-deferral strategy used by many real estate investors. It’s sometimes called a “like-kind exchange” because the rules require you to swap one property for a similar one. This tax provision allows investors to sell a property and reinvest the proceeds into a new property of equal or greater value, all while deferring capital gains taxes that would normally be incurred in a sale.

A successful 1031 exchange requires a Qualified Intermediary (QI), a third-party, who will facilitate the process and ensure compliance with IRS regulations. The QI holds the proceeds from the sale of your property until the acquisition of the replacement property is completed. As long as the new property is a “like-kind” property and of equal or greater value than the original property, then the entire gain, or a portion of the gain*, from the sale is unrealized and taxes are delayed until a normal sale occurs.

* We will get into the details of the tax implications below.

Essentially, a 1031 exchange allows real estate investors to preserve their unrealized equity by temporarily shielding it from taxes. There are many benefits to this as explained below.

Types of 1031 Exchanges

Like-kind exchanges can take many forms, but there are basically three types.

Simultaneous Swap

The simplest, but rarest, type of Section 1031 exchange is a simultaneous swap of one property for another. This can happen, for example, when two parties agree to swap deeds on the same day, or through an intermediary.

Deferred Exchange

Deferred exchanges are the most common form of 1031 exchanges. This is when an investor sells a property BEFORE acquiring one or more like-kind replacement properties. These exchanges are more complex but allow for more flexibility. They allow you to dispose of a property and subsequently acquire one or more other like-kind replacement properties.

Simply buying a new property with the funds from the sale of an old property will not qualify as a Section 1031 exchange. The sale of one property and the acquisition of the replacement property must be dependent on each other. Deferred exchanges generally require exchange facilitators who act according to strict tax regulations.

Reverse Exchange

A reverse exchange is when you sell your property AFTER you acquire the replacement property. Reverse exchanges are somewhat more complex than deferred exchanges. Typically, they involve purchasing a property owned by an exchange facilitator, often in an all cash deal. The exchange facilitator holds onto the property for up to 180 days until the taxpayer disposes of the relinquished property to close the exchange.

Benefits of a 1031 Exchange

There are many benefits to a 1031 Exchange in real estate transactions. These benefits can generally be divided into Tax Deferral, Wealth Building, and Portfolio Management benefits.

Tax Deferral Benefits of 1031 Exchanges

The primary advantage of a 1031 exchange is the ability to defer, if not avoid altogether, the immediate tax liability that results from a sale of a rental property. When a rental property is sold, it will be subject not only to Capital Gains Tax of up to 20%, but also to Depreciation Recapture tax of 25%. If you earn over $250,000 jointly or $200,000 as a single taxpayer, the sale will also be subject to the 3.8% Net Investment Income Tax.

Clearly a 1031 exchange can result in significant tax savings. This tax deferral has several additional benefits.

Preservation of Equity

Real estate investors and landlords can preserve a substantial portion of their equity from the sale by deferring Capital Gains and other taxes. This retained equity provides increased purchasing power to acquire a better replacement property.

Enhanced Cash Flow

Real estate investors who use a 1031 exchange can roll their bigger proceeds into better performing assets with higher cash flow and potentially higher returns on investment.

Tax-Deferred Compounding

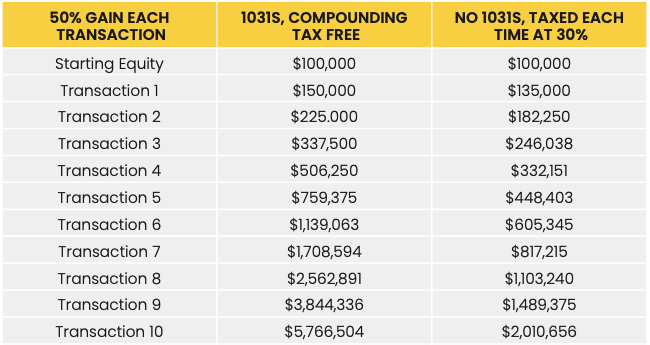

In theory, real estate investors can continuously defer taxes through repeated 1031 exchanges, thereby compounding the growth on the full value of their investments without losing funds to Capital Gains and other taxes. See the example below.

Wealth Building Benefits of 1031 Exchanges

There are several wealth building benefits of a 1031 exchange and while they are directly related to the tax deferral benefit, they are worth mentioning.

Increased Portfolio Value

As illustrated in the example below on “compounded equity”, real estate investors can significantly accelerate the growth of their portfolio by repeatedly using the 1031 exchange tax provision. This is the real power of a 1031 exchange!

Asset Appreciation

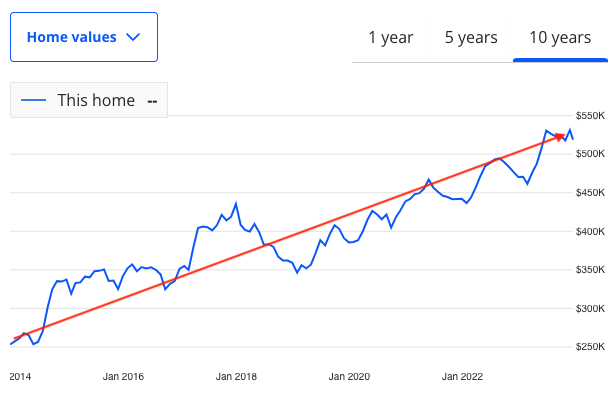

As a landlord and real estate investor, you may find that your property appreciation has slowed or does not keep up with the local market’s average appreciation rates. That’s because some markets may be declining or certain asset classes like multifamily properties and condos do not follow the same appreciation patterns as single family homes.

Here’s an illustrative example with two different properties. You can see by the images above that the single family home has seen steady price gains while the condo has stalled in appreciation. This may be a good reason to use a 1031 exchange to realize faster appreciation by diversifying into better markets or asset classes.

Tax Avoidance and Estate Planning

Real estate investments, including rentals, that are passed on to heirs, enjoy a stepped-up cost basis. This means that the cost basis to the heirs is the current market value, not the original owner’s cost basis. This tax treatment essentially eliminates the Capital Gains and Depreciation Recapture Tax liabilities.

This is also true for properties that were acquired via a 1031 exchange. However, the property that has been acquired through several 1031 exchanges will enjoy a significantly bigger benefit when inherited because it has a bigger built-in tax liability that will be wiped away upon inheritance. Hence the term “swap ‘til you drop.”

Portfolio Management Benefits of 1031 Exchanges

In addition to the tax deferral and related wealth building benefits, 1031 exchanges also offer a number of real estate portfolio management benefits. These include helping investors shift their holdings into better performing assets, diversify their holdings, and reducing overall asset risk all without the burden of paying taxes.

Property Upgrades

The tax-deferred nature of 1031 exchanges allows investors to consider upgrading their portfolio by acquiring properties with potentially higher income potential or better growth prospects as illustrated in the examples above.

In this example, you may want to consider selling the condo under the 1031 exchange rules and investing the proceeds into another single family home or even a multifamily in another market to increase cash flow.

Property Type Diversification

Sometimes, certain property types experience downturns. Luxury homes and commercial properties have been under price pressure for years now. Larger real estate investors with multiple properties can use a 1031 exchange to diversify across different types of properties, such as single family homes, multi family homes, or raw land. This allows them to adjust their portfolio mix based on changing market conditions, risk tolerance, and investment objectives.

Geographical Diversification

Similar to property types, real estate markets can experience downturns as well. Investors can use 1031 exchanges to diversify their holdings geographically by exchanging properties located in one region for those in another.

Downsides of 1031 Exchanges

Clearly 1031 exchanges offer several attractive benefits, but they are not without their challenges that also need to be considered carefully.

Strict Rules and Deadlines

The IRS rules that govern Section 1031 of the tax code are complicated and strict with many deadlines that must be adhered to in order for the transaction to qualify for the beneficial treatment. See Pub 544 under non-taxable exchanges for details.

Failure to comply with these regulations, such as the 45-day identification period, or the 180-day exchange period, can result in the disqualification of the exchange. In other words, you will get a big tax bill if the IRS determines you failed to meet the strict requirements. In addition, some states, such as California, impose their own rules further complicating the process.

No Access to Cash From the Sale

In order to defer the total tax liability from a qualified sale, an investor can never receive any portion of the proceeds from the sale of the relinquished property. Not even for a minute before the completion of the exchange. Instead, the proceeds must be held by a Qualified Intermediary during the exchange process. If you need immediate cash from the sale of an investment property, then a 1031 exchange is not for you.

What is Boot?

Boot is anything received in a 1031 exchange that is not considered like-kind property. Receiving any boot will trigger tax consequences. Cash is considered boot and that’s why you will be taxed on the gains to the extent you receive cash instead of like-kind property.

This rule makes it harder to structure more creative deals. For example, debt relief, personal property, installment notes are all considered forms of boot and can’t be used in a 1031 exchange without tax consequences.

Delayed Taxes

While a 1031 exchange defers capital gains and depreciation recapture taxes, it does not eliminate them. If the replacement property is later sold without using the 1031 exchange provision, then capital gains and recaptured depreciation may be subject to taxation.

Limited Exit Strategies

Although the rules are rather loose, you are required to find a like-kind property to reinvest in or the exchange will be taxable. You cannot exchange a rental for a personal use vacation home for example.

Complexity and Professional Fees

The 1031 exchange process can be complex. It requires the involvement of professionals such as tax advisors, legal counsel, and Qualified Intermediaries. While standard exchange fees can range from a few hundred dollars up to $1,500, more complex exchanges will cost much more. The associated fees and administrative work can be burdensome compared to a regular sale so they should also be considered.

Market Timing Risk & Pressure

Because 1031 exchanges are subject to strict timelines, investors sometimes find themselves making less-than-ideal exchanges just to avoid the taxes. The market may take a downturn during the process or you may have to opt for a less than desirable property that is valued sufficiently to avoid any boot (and, therefore, tax consequences). Under normal sales transactions, you are not bound by these constraints and can take your time to find the best replacement property.

However, despite these downsides, the advantages of a 1031 exchange often outweigh the challenges and it is worth considering a 1031 exchange.

1031 Exchange Rules for Landlords and Real Estate Investors

In order to avoid the capital gains and other taxes on your exchange, you must comply with the rules established by the IRS. Failure to strictly comply will result in your exchange being treated as a taxable event. Here are the fundamental rules you must follow to avoid this:

Like-Kind Property

The properties exchanged (your old property and the newly acquired one) must be “like-kind.” This generally means that the nature or character of the property are sufficiently similar. It does not mean that they have to be the same grade or quality.

When it comes to real estate, almost all real property is considered like-kind to other real property. This is true regardless of asset class or quality. For example, an exchange of vacant land for a commercial property or an exchange of Class A residential property for Class C residential property will both qualify as a like-kind exchange. Even mineral rights and leasehold interests can qualify as like-kind under certain conditions. The definition is very broad.

One major exception to this is that real property within the U.S. is NOT considered like-kind to real property outside the U.S. Also note that the Tax Cut and Jobs Act of 2017 narrowed the definition of Like-Kind properties by limiting the amount of personal property that could be included in a real property exchange.

Qualified Use

Both the property being sold and the replacement property must be held for business or investment purposes. Properties held for personal use, such as a primary residence, do not qualify for 1031 exchange tax treatment. This means that you cannot exchange a rental property for a second personal home on a lake for example. Beware of intermediaries who tell you this is possible!

Replacement Property Identification

45-Day Rule

The exchanger must identify potential replacement property or properties within 45 calendar days after the sale of the relinquished property. Alternatively, you must identify the property or properties you will sell within 45 days of acquiring a replacement property in a Reverse Exchange. There is no extension of this deadline for weekends or holidays.

Notice Requirements

The identification must unambiguously identify the replacement property in writing using one of the identification methods allowed by the IRS. This means using the legal address found on the title. The identification notice must be in writing, signed by you, and delivered to a person involved in the exchange, typically your qualified intermediary. Note that notice to your attorney, real estate agent, accountant or any other non-qualified intermediary is generally not sufficient.

Number of Replacement Properties

You are generally only allowed to identify three potential replacement properties. You can identify more replacement properties, but then you will be subject to additional rules. See “200% Rule” and “95% Rule” below.

Identifying More Than Three Replacement Properties

There is an additional test you must pass if you identify more than three replacement properties. You must also meet one of the below requirements in addition to the identification rules above.

200% Rule

The combined value of the replacement properties cannot exceed 200% of the value of the property you are selling. Unless…

95% Rule

…the value of the properties acquired is at least equal to 95% of the combined replacement value identified.

Replacement Property Acquisition Period (180 Day Rule)

The exchanger has 180 calendar days from the sale of the relinquished property or purchase of the replacement property (whichever is first) to complete the acquisition of the replacement property or sell the relinquished property (whichever is second). This period starts when the first transaction occurs and includes the 45-day identification period. Again, there is no extension of this deadline.

Tax Nerd Tip:

Actually, there is one allowable extension identified by the IRS: this period could be extended in the event of a presidentially declared disaster. Let’s hope that you don’t qualify for that extension!

Qualified Intermediary:

To facilitate the exchange, the exchanger must use a qualified intermediary (QI) or accommodator who will (1) secure the proceeds from the sale of the relinquished property, (2) ensure that the funds are used to acquire the replacement property, and (3) prepare the necessary exchange documentation.

Neither you nor your relatives can act as your own QI. Nor can they have been an “agent” of yours in the past two years (think Accountant, Lawyer, Real Estate professional, etc.).

Note that you must have an agreement in place with your qualified intermediary BEFORE the first transaction occurs.

PRO TIP: Be sure to only work with a reputable QI. Ensure they are solvent and will be in business at the end of the 1031 exchange. There is no extension if your QI goes into bankruptcy.

No Receipt of Proceeds

In order to qualify for tax deferred treatment, the seller of an investment property must never receive the proceeds from the sale. This includes constructive receipt (you could have received the proceeds). All funds must be held by the qualified intermediary until the close of the 1031 exchange transactions to avoid triggering a taxable event.

Partial Tax Deferral

It is possible to successfully receive SOME proceeds or other non like-kind property and still receive PARTIAL tax deferral. As long as none of the proceeds were received prior to the close of the exchange transactions, and you followed the requirements, the transaction will qualify for partial tax deferral.

You are only taxed on the portion of the gain that is attributable to the proceeds received. For example, if you received 25% of the proceeds from the transaction at the conclusion of the 1031 exchange, then 25% of the gain will be taxed. The remaining 75% of the gain will be deferred and deducted from the cost basis of the new property.

Equal or Greater Value

It’s a common misconception that the new investment property must be worth at least as much as the property you are selling. While it’s true that In order to fully realize the tax deferral benefit of a 1031 exchange, the value of the replacement property must be of equal or greater value than the relinquished property. However, you may be able to realize some tax benefits even if the value of the new property is less than the value of the relinquished property.

Reinvestment of Equity

As mentioned earlier, the exchanger must reinvest all of the equity (cash proceeds) from the relinquished property into the replacement property to defer all potential capital gains taxes.

Same Taxpayer

The taxpayer who sells the relinquished property must be the same taxpayer who acquires the replacement property. Practically speaking this means the taxpayer on the titles and the loan documents must match in both transactions. No change of ownership is allowed in a 1031 exchange.

Use of Exchange Funds

The qualified intermediary can only use the funds held for the purchase of the replacement property. The proceeds cannot be used for any other purpose. Any unused funds may be returned to the exchanger after the exchange period expires, but as explained earlier, this will trigger partial taxation of the gains.

No Personal Property Exchange

While you can receive a portion of your proceeds in the form of personal property, doing so will subject that proportional amount of gain to taxes.

Exchanges Involving Partnerships

Special rules apply to exchanges involving partnerships when one partner wants to cash out instead of participating in the exchange. Consult with a tax professional if this is the case for you.

Real Property Dealers and Flippers

1031 exchanges are only allowed if the property is held for use in a trade or business or for investment purposes. This means that real estate dealers and flippers, who hold real property as inventory, do not qualify for 1031 exchange treatment. This makes sense because if they were allowed to defer the gains, their business would never be taxed.

Real Property Held for Less Than Two Years

While there is no technical requirement that relinquished property be held for a specific length of time, some sources suggest that the property should be held for more than two years to avoid IRS challenges.

Example 1031 Exchange Transaction

Let’s look at an example to illustrate the difference between a regular sale and a typical 1031 reverse exchange.

Relinquished Property

Larry the landlord has owned a rental property for several years and has decided he wants to sell this one and use the proceeds to trade up to a bigger rental property. The first step is to calculate his Net Selling Price:

Regular Sale | 1031 Exchange | |

Contract Sale Price | $500,000 | $500,000 |

Agent Commissions | -25,000 | -25,000 |

Title Fees & Closing Costs | -5,000 | -6,500 |

NET SELLING PRICE | $470,000 | $468,500 |

Larry agrees to sell his rental for $500,000 and incurs $25,000 of agent commissions in both scenarios. However, the closing costs are higher in the 1031 exchange because Larry is using a Qualified Intermediary to handle the transaction. The cost is $1,500 for this type of standard exchange.

In order to avoid a partial taxable event, Larry will need to invest in a replacement property worth at least $468,500.

Equity

The next step is to determine Larry’s Equity, or the proceeds he will receive at the close of the sale of his rental property.

Regular Sale | 1031 Exchange | |

Net Selling Price | $470,000 | $468,500 |

Mortgage Pay Off | -250,000 | -250,000 |

EQUITY | $220,000 | $218,500 |

Larry has an outstanding mortgage pay off balance of $250,000. After the sale and paying for any closing costs, Larry will receive cash of $220,000 under a regular sale and $218,500 under a 1031 exchange sale.

Larry will need to invest at least $218,500 in cash into the replacement property in order to avoid any taxes on the sale.

Capital Gain and Taxes

So far, the transactions look essentially the same. The real difference is in the taxes owed. To calculate the taxes, we first need to determine Larry’s costs basis in the rental property. This will be the same in either scenario.

Regular Sale | 1031 Exchange | |

Original Purchase Price | $250,000 | $250,000 |

Capital Improvements | 20,000 | 20,000 |

Title Fees & Closing Costs | 2,500 | 2,500 |

Depreciation | -62,727 | -62,727 |

COST BASIS | $209,773 | $209,773 |

Larry purchased the property 10 years ago for $250,000 and invested an additional $20,000 in capital improvements to make it a great rental. Including closing costs of $2,500, Larry’s total investment was $272,500. The land was worth about $100,000 at the time, leaving Larry with a building cost basis of $172,500.

Over the years, he has taken $62,727 ($172,500 building cost basis ÷ 27.5 useful life x 10 years) in building depreciation deductions which reduced his cost basis. Now we can calculate his Capital Gains.

Regular Sale | 1031 Exchange | |

Net Selling Price | $470,000 | $468,500 |

Cost Basis | -209,773 | -209,773 |

CAPITAL GAINS | $260,227 | $258,727 |

Again, the differences here are minimal. The real difference is in the taxes owed.

Let’s assume Larry has reinvested in a replacement property worth at least $468,500 AND put at least $218,500 cash into the property, then his capital gain will be deferred under the 1031 exchange sale but not under the regular sale.

Regular Sale | 1031 Exchange | |

Capital Gains | $260,227 | $258,727 |

Taxes (27.8%*) | -72,343 | 0 |

AFTER TAX PROCEEDS | $187,884 | $258,727 |

Under the regular sales transaction, Larry will incur taxes of up to 27.8% which include 20% Capital Gains, 3.8% Net Investment Income, and an average 4% State Income Taxes. This reduces Larry’s after tax proceeds by over $72,000!

Following the 1031 Exchange rules, Larry has significantly increased his net worth versus a regular sale and now has more funds to reinvest into more wealth-building assets.

Replacement Property Cost Basis

There’s one more important difference to illustrate. Remember, that the taxes on a 1031 exchange are not avoided, they are only deferred. The mechanism for this is via the cost basis of the replacement property.

Regular Sale | 1031 Exchange | |

Replacement Property Purchase Price | $600,000 | $600,000 |

Title Fees & Closing Costs | $7,500 | $7,500 |

Deferred Capital Gain | 0 | -258,727 |

COST BASIS | $607,500 | $348,773 |

The replacement property that Larry acquired under the 1031 exchange tax code has a much lower cost basis. If Larry then sells the replacement property under a regular sale, he will be subject to the taxes owed on the original deferred amount of $258,727.

For example, if Larry sells the replacement property for $900,00 his gain will be $292,500 under the regular sale ($900,000 – $607,500) versus $551,227 ($900,000 – $348,773) if he originally used a 1031 exchange to acquire the replacement property. Of course, Larry can opt to do another 1031 exchange to defer the tax liability again and continue to compound his equity.

Compounded Equity

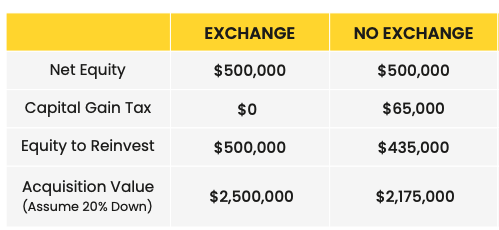

It’s great to defer the taxes, but that’s not the real power of a 1031 exchange. The real power of a 1031 exchange is in the ability to leverage that preserved equity (in the form of deferred taxes) and use it to buy an even bigger asset. With more money in your hand after a sale, you can buy more property. Here’s an example taken from 1031Specialists.com

As you can see, the extra $65k at closing affords you an extra $325k in property value assuming an 80% loan to value ratio. And now watch how the extra equity compounds:

Assuming the same transactions with the same returns, at the end of 10 tax-deferred exchanges, you will end up with 287% the equity versus the same transactions that are taxed each time. That’s the true power of a 1031 exchange!

Common 1031 Exchange Mistakes to Avoid

Clearly the tax avoiding and wealth-building benefits of a 1031 exchange make them attractive but the complexity can often intimidate landlords. A successful 1031 exchange hinges on strict adherence to the rules and avoiding these common mistakes.

Missed Timelines

As I’ve stressed several times, failing to adhere to the strict timelines will disqualify the exchange from tax deferred status and subject you to a lot of taxes. Don’t miss a deadline. A good QI will keep you on track.

Improper Identification

Incomplete or inaccurate identification of replacement properties can jeopardize the exchange. Improper notice will do so as well. Use the property’s legal description and provide written notice signed by all exchangers before the 45 day deadline.

Non-Like-Kind Property Exchange

Almost all real for real property exchanges qualify as a “like kind” exchange but there are exceptions. Also, you can’t receive cash or other non-Like-Kind property as part of the deal if you want to defer all taxes. Make sure your exchange qualifies as a Like-Kind exchange.

Not Investing Enough into the Replacement Property

In order for a 1031 exchange to fully qualify for favorable tax treatment, you must find a replacement property worth at least as much as the net selling price of the relinquished one. You must also reinvest at least as much cash as you received from the sale of the relinquished property (your equity).

Ignoring Property Use Requirements

Both the relinquished and replacement properties must meet the IRS’s requirements for business or investment use. Otherwise the transaction will be taxable. Personal-use property or property held as inventory will not qualify.

Not Having a Plan

You need to have a plan in place before conducting a proper 1031 exchange. That’s because the rules and time restrictions are rigid. Failure to adhere to them will disqualify the exchange from the tax deferred status. This means finding a QI, scouting for replacement properties, and making sure your transactions will occur on the timeline. Failure to plan for these things may lead to incomplete due diligence and bad financial decisions.

Ignoring State-Specific Rules

1031 exchanges are governed by federal tax code and IRS rules but your state may impose its own rules and regulations related to 1031 exchanges. Failure to take this into account can result in unexpected tax liabilities at the state level.

Not Using a Qualified Intermediary

IRS rules require you to use a Qualified Intermediary to conduct the exchange. Without this, the exchange is disqualified. Also, they need to be independent. You can’t use your real estate agent or lawyer. Finally, your QI must be identified and in place BEFORE you close the first transaction.

What to Look for in a Qualified Intermediary

Clearly having a Qualified Intermediary is critical to the success of a 1031 exchange. That’s why it’s so important to find a good one. Here are a few things to look for in a Qualified Intermediary.

Experience and Expertise

You want to look for a Qualified Intermediary with a solid track record and extensive experience in handling successful 1031 exchanges. They should have a deep understanding of the rules related to 1031 exchanges and be able to explain them to you in an easy to understand manner.

Reputation

Research their independent reviews, testimonials, and references from previous clients, not just the ones on their website. Do they try to steer you into buying their own properties? Consider recommendations from trusted professionals in the real estate and financial industry. Who do you know that’s done a 1031 exchange? Who did they use and would they use them again?

Credentials and Licensing

As important as Qualified Intermediaries are to the 1031 exchange process, they are relatively under regulated. Only a handful of states require that QI’s be certified (there is no federal requirement). Not having a certification such as a Certified Exchange Specialist (CES®), doesn’t necessarily mean a QI is not good, but you may want to look for one that is certified if you are concerned.

Financial Stability

Your QI will be holding onto your funds for a long time. It’s important to choose an intermediary with financial stability to ensure they will not become insolvent in the interim. You also want to make sure they hold your funds in a safe place such as an FDIC insured trust account and not in risky investments.

Just ask anyone caught up in the 2008 bankruptcy of LandAmerica 1031 Exchange Services.

Customer Service

How responsive and communicative are they? Your QI is your guide through the 1031 exchange process. Make sure they are willing to walk you through the process and are available when you need them.

Security Measures

A good QI has multiple security measures in place to safeguard your funds. They should have protocols in place to ensure only you can access your funds. Inquire about the security measures in place to protect funds during the exchange, such as using segregated accounts, fidelity bonds and insurance.

Clear Fee Structure

It’s not unusual to be quoted a low fee only to find many add on expenses during the process. Your QI should have a clear fee structure that they communicate upfront. Always ask if there are any hidden fees that could arise later.

By carefully considering these qualities, you can increase the likelihood of a successful 1031 exchange and minimize potential risks. Always consult with legal and financial professionals for advice tailored to your specific situation.

Conclusion

1031 exchanges are powerful, but complicated, mechanisms to defer taxable gains, retain your hard-earned equity, and build long term wealth. The rules need to be strictly adhered to in order to be recognized for favorable tax treatment. Your situation is unique and you should always seek knowledgeable, professional advice before making any financial decisions. Finding a good Qualified Intermediary is the first step in this process.

Pingback: Time Requirements for Renting in a 1031 Exchange